Introduction

The ease of use provided by mobile payment applications has completely transformed the way we handle financial transactions, especially for recurring subscriptions. Whether it’s your favorite streaming service, gym membership, or monthly utility bills, these apps make it easy to set up automatic payments. But are mobile payment apps safe for recurring subscriptions?

This comprehensive guide will explore how mobile payment apps work for recurring payments, the security features they employ, the risks involved, and the best practices to ensure your payments are secure. We’ll dive into expert insights, real-world examples, and compare mobile payment apps to other payment methods to help you make an informed decision.

Table of Contents

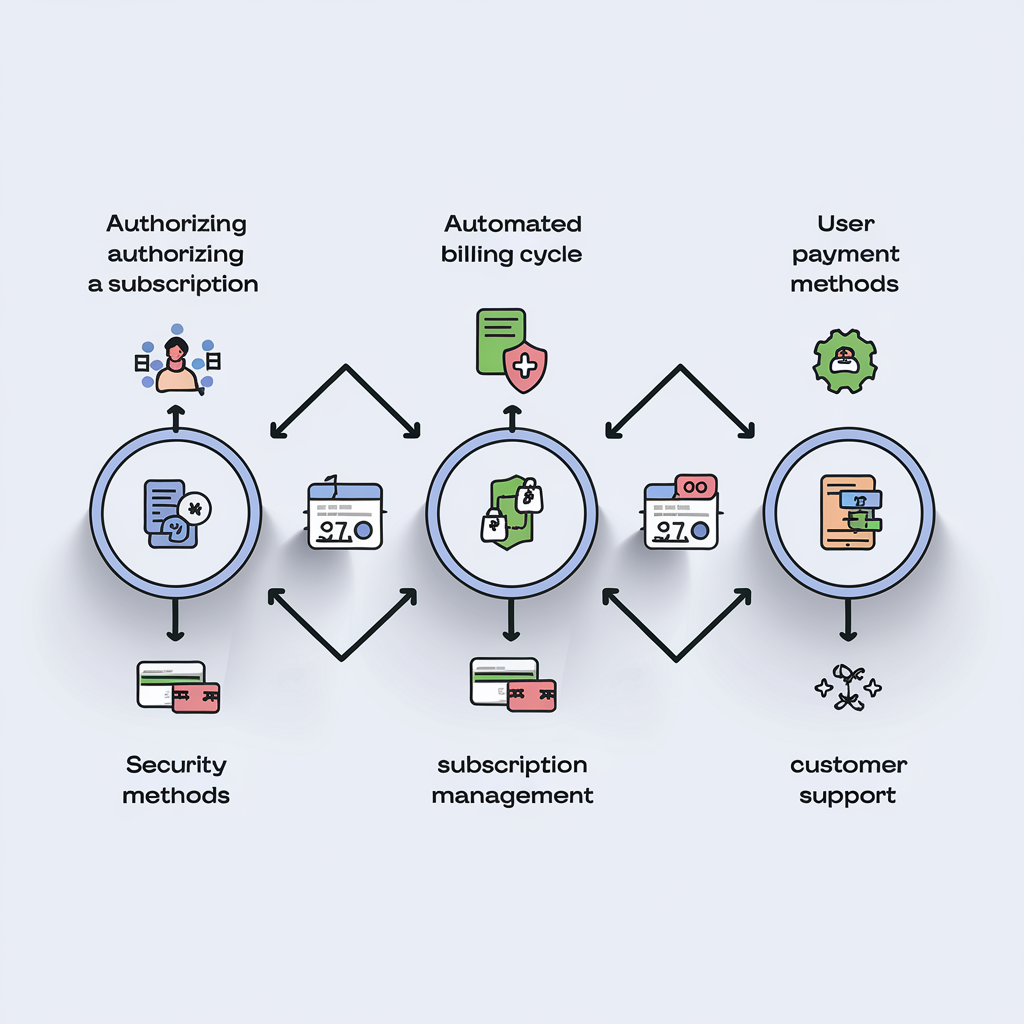

How Mobile Payment Apps Handle Recurring Subscriptions

Mobile payment apps like PayPal, Google Pay, and Apple Pay simplify the process of setting up recurring payments. They allow users to link their credit or debit cards or bank accounts to pay for subscription services like Netflix, Spotify, Amazon Prime, and more. But how do these apps manage these recurring transactions behind the scenes?

Authorization and Payment Setup

When you first subscribe to a service using a mobile payment app, you give the app permission to store your payment details and authorize future charges on your behalf. This permission is typically given through an encrypted transaction where you enter your card details, which are then securely stored or tokenized.

- Tokenization: Instead of storing your actual card number, many apps use a process called tokenization, where your card number is replaced by a random string of characters (a token). This token is used for future transactions, keeping your sensitive data hidden.

Automatic Billing Process

Once the setup is complete, the app automatically charges your card or account at the specified intervals (monthly, yearly, etc.). The service provider sends a request for payment, and the app processes it using the stored token or card details.

- Instant Notifications: Most apps notify users in advance when a payment is about to be made, offering a chance to review or cancel the subscription if necessary.

Popular Payment Apps for Recurring Subscriptions:

- PayPal: One of the most widely used mobile payment platforms, PayPal allows recurring payments for numerous services worldwide.

- Google Pay: Google Pay enables users to manage subscriptions easily and integrates seamlessly with Google’s ecosystem, including YouTube and Play Store.

- Apple Pay: Apple Pay is known for its simplicity and security, especially for users with Apple devices. It supports recurring subscriptions for a wide range of services.

- Venmo: Widely used in the U.S., Venmo allows recurring payments for personal and business transactions, offering integration with various services and platforms.

- Samsung Pay: Samsung Pay provides similar features as Apple Pay, with the added advantage of being widely compatible with both older and newer card machines, making it ideal for recurring subscriptions.

- Amazon Pay: Amazon Pay is not only for e-commerce but also supports recurring payments for services like Prime memberships and third-party subscriptions.

- Stripe: Stripe is commonly used by businesses for subscription-based models, especially in SaaS and online services, ensuring secure recurring payments.

- Square: Square is well-liked by small businesses and provides choices for recurring payments, particularly in the service industry.

- Cash App: Cash App allows users to set up recurring payments for personal transactions and some business services, adding convenience for regular payments.

Each of these apps comes with its own strengths, security protocols, and user base. They make managing recurring subscriptions convenient, but it’s essential to choose the app that fits your needs and provides strong security.

- Learn more about how Google Pay handles recurring payments directly from Google Support.

- Apple Pay Security provides detailed insights into how Apple ensures the

Security Features of Mobile Payment Apps

Mobile payment apps incorporate several layers of security to protect users, especially when dealing with recurring payments. Let’s take a closer look at these security features:

Encryption

Most mobile payment apps use end-to-end encryption to secure users’ sensitive information during transactions. This means that your payment data is converted into unreadable code during transmission and can only be decrypted by authorized systems.

- AES-256 Encryption: Many apps, including PayPal and Apple Pay, use AES-256 encryption, one of the most secure encryption standards used by financial institutions and government entities.

Tokenization

As mentioned earlier, tokenization is a process where your real card information is replaced by a token. This means that even if hackers intercept your data, they won’t have access to your actual card number, significantly reducing the risk of fraud.

- Example: In 2020, Apple Pay reported zero instances of card fraud through tokenized payments in its system, a testament to how effective this security method can be.

Two-Factor Authentication (2FA)

Two-Factor Authentication (2FA) enhances the security of mobile payment apps by adding an extra step beyond just your password. It involves a secondary verification method, like a code sent to your phone or biometric methods such as fingerprint or facial recognition.

- Why It Matters: According to a report by Symantec, accounts with 2FA enabled are 99% more secure compared to systems that depend only on passwords.

Biometric Authentication

A lot of mobile payment applications currently offer capabilities for biometric authentication, like fingerprint scanning or facial recognition, to guarantee that only authorized users can access the app. This method is especially effective in safeguarding accounts from unauthorized access.

- Example: Venmo introduced facial recognition and fingerprint scanning to its app in 2022, increasing its overall security for recurring payments.

Fraud Detection Algorithms

Advanced mobile payment apps also use machine learning algorithms to detect unusual activity on accounts. These algorithms analyze user behavior and can flag or block suspicious transactions before they are processed.

- Case Study: In 2021, Google Pay reported that its AI-powered fraud detection systems prevented over $1.5 million in fraudulent transactions related to recurring payments.

Security Features of Popular Mobile Payment Apps (Comparison Chart)

| Feature | PayPal | Google Pay | Apple Pay | Venmo | Samsung Pay |

|---|---|---|---|---|---|

| Encryption | AES-256 | AES-256 | AES-256 | AES-256 | AES-256 |

| Tokenization | Yes | Yes | Yes | Yes | Yes |

| Two-Factor Authentication | Yes | Yes | Yes | Yes | Yes |

| Biometric Authentication | Yes (Fingerprint) | Yes (Fingerprint) | Yes (Face ID) | Yes (Fingerprint) | Yes (Iris Scan/Fingerprint) |

| Fraud Detection Algorithms | Yes | Yes | Yes | Yes | Yes |

Potential Risks of Using Mobile Payment Apps for Recurring Subscriptions

While mobile payment apps come with numerous security features, they are not completely immune to risks. Here are some of the potential dangers users should be aware of:

Data Breaches

Even with encryption and tokenization, data breaches remain a concern for mobile payment apps. If a hacker gains access to a payment provider’s database, they could potentially obtain sensitive information, though usually in tokenized or encrypted form.

- Real-World Example: In 2022, Cash App experienced a data breach that exposed the personal information of 8.2 million users, though no financial data was compromised due to encryption protocols in place.

Read about the biggest data breaches of the 21st century from CSO Online.

Unauthorized Recurring Payments

Sometimes, users may be unaware of certain subscription services or fail to cancel a recurring payment, leading to unauthorized charges. Some companies may even engage in unethical practices by making it difficult to cancel subscriptions.

- Pro Tip: Regularly reviewing your subscription list within the app can help prevent unwanted charges.

Phishing Attacks

Phishing is another threat where scammers deceive users into sharing their login credentials through fake emails or websites. Once they have access to your account, they can initiate fraudulent recurring payments or steal sensitive information.

- Preventive Measure: Never click on links from suspicious emails. Always log in directly to the app via a secure connection.

App-Specific Vulnerabilities

Different apps may have unique vulnerabilities based on their code, usage patterns, or integration with other services. These risks can vary depending on the app’s developer practices and response to vulnerabilities.

Best Practices for Ensuring Safety When Using Mobile Payment Apps

To reduce risks and enhance the security of your recurring subscriptions, here are the best practices to follow:

Stick to Trusted Apps

Only use well-known, trusted mobile payment apps with strong reputations for security. Apps like Apple Pay, Google Pay, and PayPal have comprehensive security protocols in place and are more likely to detect and prevent fraudulent activities.

Monitor Your Transactions Regularly

Make it a habit to regularly check your transactions for any signs of unauthorized charges. Most apps offer easy access to your transaction history, making it simple to spot any irregularities.

- Tip: Set a monthly reminder to review your subscriptions and recurring charges. Some apps, like Revolut, even categorize your payments so you can quickly identify recurring charges.

Enable All Available Security Features

Most apps offer optional security features, such as two-factor authentication, biometric login, or transaction alerts. Activate these features to strengthen your account’s security with additional layers of protection.

Update Your Apps and Devices

Ensure that both your mobile payment apps and your smartphone’s operating system are up-to-date. Updates often include crucial security patches that protect against newly discovered vulnerabilities.

Avoid Using Public Wi-Fi

Public Wi-Fi networks are often unencrypted and easy for hackers to exploit. When making payments or accessing financial apps, always use a secure, private connection.

Use Virtual Credit Cards

Some financial institutions offer virtual credit cards for recurring payments. These cards can be set up with a unique number and expiration date, which protects your actual card details from being exposed.

Mobile Payment Apps vs. Other Payment Methods for Recurring Payments

If you’re considering whether mobile payment apps are safer or more convenient than traditional payment methods, here’s how they compare:

Mobile Payment Apps vs. Credit Cards

- Convenience: Mobile payment apps make recurring payments seamless by storing your information and automating the process. Credit cards, while secure, often require manual input for each subscription.

- Security: Credit cards offer robust fraud protection and zero-liability policies, but mobile apps go a step further with features like tokenization and 2FA.

Mobile Payment Apps vs. Bank Transfers

- Speed: Bank transfers can take days to process, while mobile payment apps handle transactions instantly.

- Security: Bank transfers are highly secure but lack the convenience and flexibility of mobile apps.

Mobile Payment Apps vs. PayPal

Global Reach: PayPal is regarded as one of the most trusted platforms worldwide and offers extensive security features for recurring payments. Mobile payment apps, however, often offer a more integrated user experience on smartphones.

Expert Insights and Case Studies

For further validation, let’s look at some expert opinions and real-world examples on mobile payment security.

Mark Johnson, a cybersecurity analyst at Symantec, emphasizes the importance of security features:

“Mobile payment apps have advanced significantly in security, but users must enable multi-factor authentication and regularly monitor transactions to minimize risks. While these apps are convenient, vigilance is key to avoiding potential breaches.”

According to a 2023 report by Statista, over 1.31 billion people worldwide use mobile payment apps. This growing reliance underscores the importance of security, especially for recurring payments where sensitive data is accessed regularly.

In a recent study by McAfee, it was found that 38% of mobile payment app users do not use additional security features like two-factor authentication, leaving them vulnerable to fraud.

Also Read: AI-Powered Fraud Detection & Prevention

Final Verdict: Are Mobile Payment Apps Safe for Recurring Subscriptions?

After exploring the security features, risks, and best practices, it’s safe to say that mobile payment apps are generally secure for handling recurring subscriptions, provided you take the necessary precautions. With features like encryption, tokenization, and two-factor authentication, these apps are designed to protect your payment data from fraudsters.

That said, users must stay vigilant, regularly monitor their transactions, and ensure they use all the available security features to reduce the risk of unauthorized charges or breaches.

Call to Action

Have you used mobile payment apps for recurring subscriptions? Share your experiences and any security tips in the comments below. Don’t forget to check out our other articles on subscription management and how to secure your digital wallets.

FAQs

Are mobile payment apps safe for recurring subscriptions?

Yes, mobile payment apps are generally safe for recurring subscriptions.

Apps such as PayPal, Google Pay, and Apple Pay implement advanced security measures like encryption, tokenization, and two-factor authentication (2FA) to safeguard your data. However, users should always monitor their transactions and enable all available security features to minimize risks.

What are the security risks of using mobile payment apps for recurring payments?

Although mobile payment apps are secure, there are some risks, including data breaches, unauthorized transactions, and phishing attacks. It’s important to regularly review your subscriptions and ensure you are using trusted, reputable apps with strong security protocols in place.

How can I protect myself when using mobile payment apps for recurring subscriptions?

To protect yourself when using mobile payment apps, follow these best practices:

- Enable two-factor authentication (2FA) and biometric login.

- Regularly monitor your transactions and cancel any unwanted subscriptions.

- Use trusted apps like Apple Pay, Google Pay, or PayPal.

- It is best to Avoid using public Wi-Fi for sensitive transactions, as it can leave your data more vulnerable to hackers. Stick to secure, private networks whenever possible and ensure your device and apps are up-to-date.

What happens if there’s a security breach with a mobile payment app?

In the event of a security breach, most mobile payment apps have robust protocols to protect users. For example, tokenization ensures that your actual card details are not exposed. You should also receive notifications if suspicious activity is detected, and many apps offer zero-liability protection for unauthorized transactions.

How do I cancel a recurring payment through a mobile payment app?

To cancel a recurring payment, go to the app’s settings or payment history section, find the subscription you want to terminate and select the “cancel” option to stop the automatic payments. Each app will have a slightly different process, but PayPal, Google Pay, and Apple Pay make it easy to manage and cancel recurring payments.

Which mobile payment apps are best for recurring subscriptions?

Some of the best mobile payment apps for recurring subscriptions include:

- PayPal: Known for its widespread use and robust security features.

- Google Pay: Seamless integration with Google services.

- Apple Pay: Ideal for Apple device users with strong privacy protection.

- Venmo, Amazon Pay, and Stripe are also reliable options for recurring payments.

Can I dispute an unauthorized recurring charge made through a mobile payment app?

Yes, most mobile payment apps allow you to dispute unauthorized charges. Contact the app’s customer service or use the in-app features to report the charge. Apps like PayPal, Apple Pay, and Google Pay offer fraud protection and zero-liability policies for unauthorized transactions.

Author: Ankush Sharma

Ankush Sharma is a technology enthusiast and financial strategist with a passion for bridging the gap between finance and innovation. As the founder of Future Fortune Path, Ankush focuses on delivering actionable insights into tech-driven financial solutions. With expertise in fintech, AI, and digital wealth management, Ankush helps readers navigate the complexities of the modern financial landscape. Through Future Fortune Path, Ankush shares cutting-edge strategies and tools designed to empower individuals and businesses to build sustainable, tech-savvy financial futures.